Speer: More Trade = Better Prices (Not So Much)

Price Discovery: Following the previous columns on grid marketing (1. Bettin’ On The Grid and 2. Profiting From The Grid) I received several emails regarding price discovery. The concerns were related to the ability and/or effectiveness of establishing a base price related to grid marketing. The comments addressed both types of grids:

- Negotiated grid – the issue being available premiums may lend cattle feeders to unintentionally become somewhat complacent around negotiation of the base price (versus selling the cattle live);

- Formula grid – the worry being these transactions are really no different than selling cattle live on a formula – there is no base price negotiation associated with the transaction.

Either way, the discussion brings us back to one of the most tenuous topics in the beef industry – price discovery.

More Trade, Better Prices: In a prior column on the topic, I quoted one commentator explaining the idea / belief trade volume and prices go hand-in-hand: “…if you have a lot of negotiated, pure cash sales then your market’s normally gonna be higher. If you don’t have very many it’s gonna be lower.”

Data: What about that claim? Three graphs are included at the end of the column. Each depicts data associated with weekly level of negotiated trade (as % of total volume) and weekly fed price.

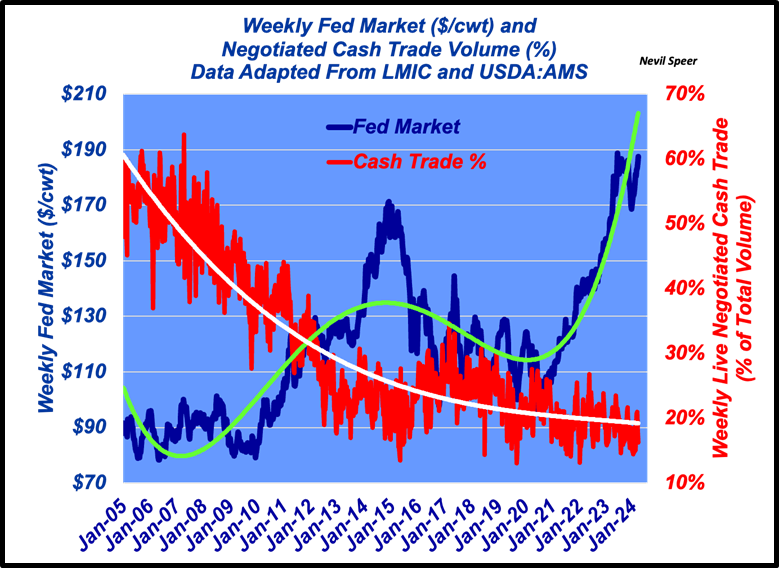

Graph 1: The first chart provides a historical overview with respect to the weekly trends. The first low-point of cash trade occurred in May, 2015 (while fed prices were still hovering around $160+). Since that time, the negotiated trend has largely flattened around ~20% of weekly volume. Meanwhile, the issue of price discovery re-emerged in ’20 and ’21 as the market slugged through Covid. And while negotiated trade hasn’t experienced any substantive change in volume, the market effectively doubled (+$95) over the course of just 35 months on its way to new highs.

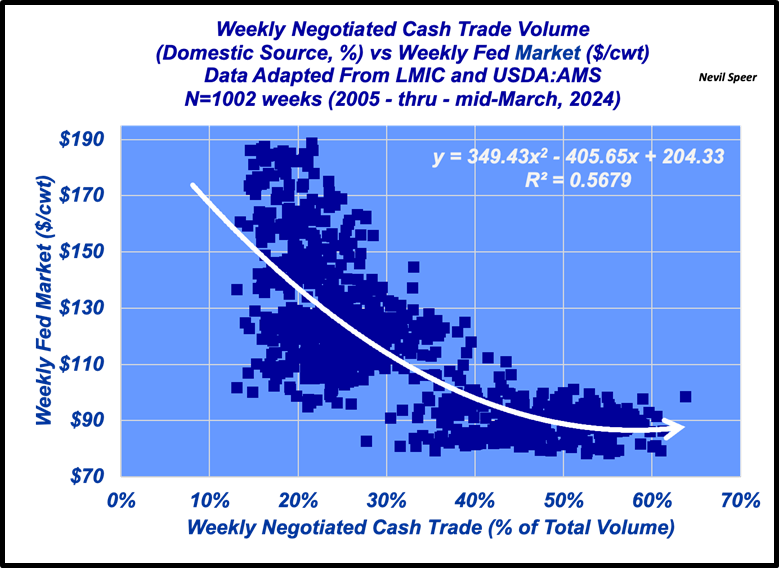

Graph 2: The second graph represents the same data as a scatter plot. As discussed in some previous columns (see 55 – 0), the trend counters the “more trade, better prices” mantra. That’s not meant to imply less cash trade makes the market stronger (correlation is NOT causation). However, the data does confound the “more trade, better prices” argument.

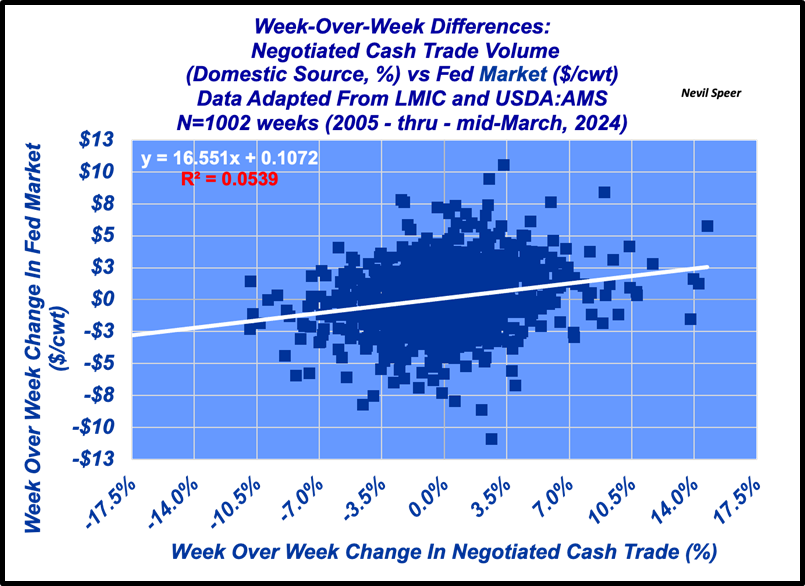

Graph 3: Despite the previous charts, some might still contend IF we had more cash trade, prices would be even higher than they are now. The only way to address that is in the week-to-week trends. What’s the relationship between more (or less) trade in any given week and subsequent influence on price?

The third chart addresses that question. A couple of things are important:

- The trend is positive – more cash trade this week (versus last) suggests better prices this week. But…does that reflect cattle feeders driving prices higher, or just chasing (selling more cattle into) a stronger market?

- Over the course of 1000+ weeks, the means for each variable is zero. That is, there are no tendencies on either side of either variable.

- Last, and most important, the difference in negotiated trade explains just north of 5% of variation in cash prices. That is, 95% of the variation in weekly cash price is driven by other factors.

No Turning Back: The data detailed here likely won’t lead the “more trade, better price” camp to rethink their perspective; that’s because their position often starts with an adversarial perspective of the business. That is, less cash trade punishes the cattle feeder while benefitting the packer (more on that in the next column).

At the very least, though, maybe – just maybe - it might help bring some objectivity to the topic (at least for some). The data also serves as an important reminder about the business. None of the changes are happenstance; there’s good reason the market has evolved the way it has – business comes before the market, not the other way around (see Business First, Market Second). And given the ever-increasing diversity in business strategies AND cattle, it’s likely (absent a mandate) there’s no turning back.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.